Business Performance Management for Finance Professionals

By Andy Burrows

You’re a Finance professional who wants to do their best for the business you work for.

You may want to rise to be a CFO one day.

If so, you must grasp business performance management.

Business performance management is a key element of the business acumen you need to be a business-focused Finance professional. And it’s something that is specifically the responsibility of the CFO and Finance.

If you want to be more than “just an accountant”; if you want to drive business performance, rather than just spectate or commentate on it, learn business performance management!

And that’s what I aim to introduce you to in this article.

Why is business performance management so important?

Business performance management is an essential discipline, because as I regularly say, “managing business performance better leads to better business performance... otherwise why bother managing it?”

Management is “maintaining control over” something. In this case we want to maintain control over the performance of the business. We don’t want to just let it happen. So, we manage it.

Now, you may not have thought about this much, so you may think to yourself, “how can you manage or maintain control over performance?” Isn’t business performance just the product of selling things that some people want to buy, and providing them effectively? Performance is just the output at the end.

How can you ever say you have control over performance, when many of the factors of performance are outside of your control? For instance, you can’t control whether people spend money on your product or service. All you can control is the way you present it to people and the way you deliver it.

But that’s really the whole point!

A framework for performance management

The point, when we talk about business performance management, is that we want to know what elements we have to pay attention to in order to effectively control what we can.

Think of it simplistically like an athlete. A very amateur or junior athlete will just turn up, compete and see if they win or lose. Top athletes have coaches who manage their performance.

Coaches guide the athlete to operate and train within a framework that will lead to better performance. And that enables them to intentionally improve their performance.

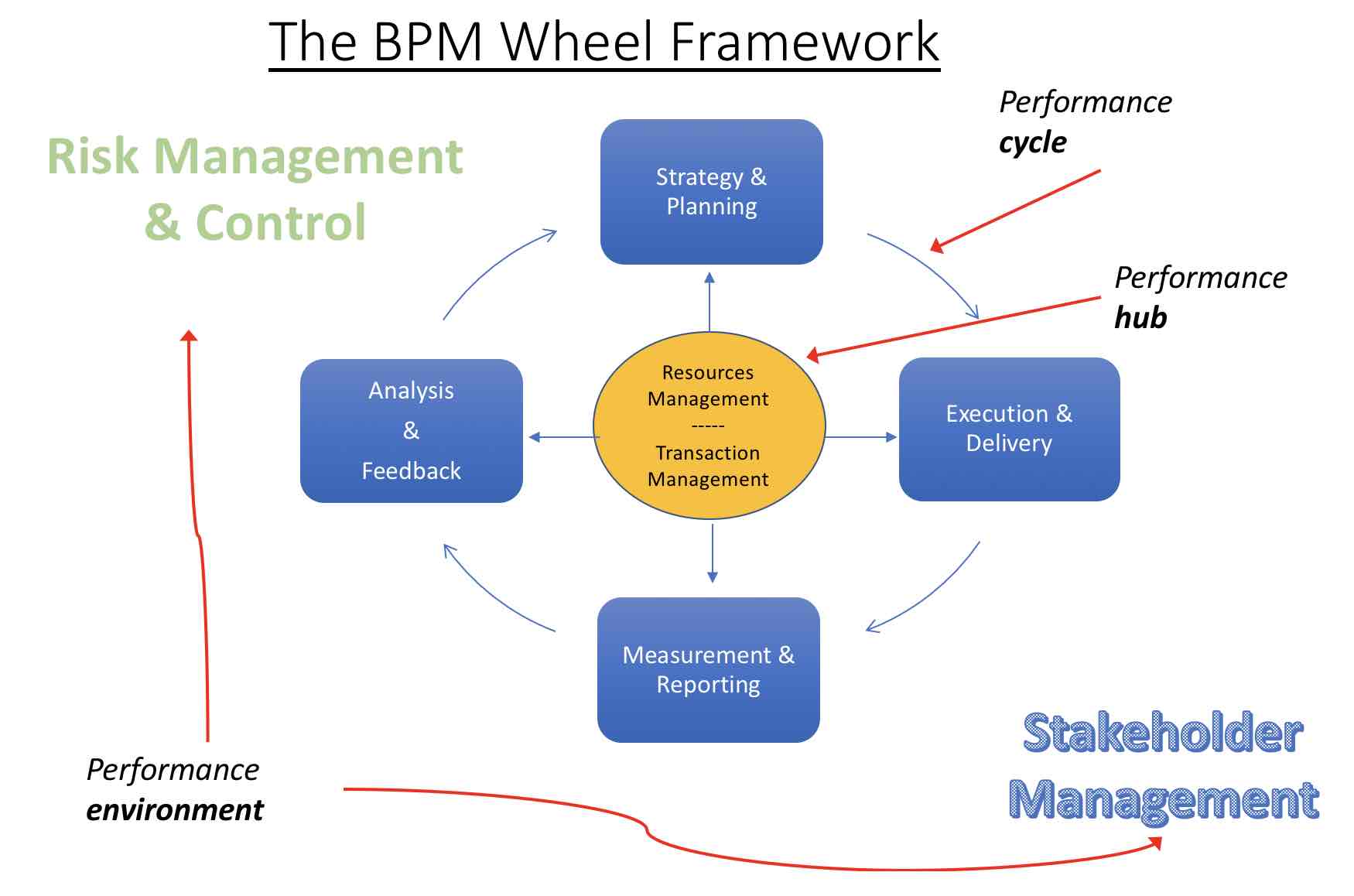

The framework I use for business performance management is what I call the BPM Wheel (see the picture below).

It’s made up of eight elements under three headings:

- The performance cycle:

- Strategy and planning

- Execution and delivery

- Measurement and reporting

- Analysis and feedback

- The performance environment:

- Stakeholder management

- Risk management and control

- The performance hub

- Transaction management

- Resource management

The performance cycle

The performance cycle is basically saying that:

- You plan what to do

- You do what you planned to do

- You measure how you did

- You analyse what went well and what could be improved, and feed that back into planning

And that’s really similar to the way an athletic coach works – think clipboard and stopwatch!

When I used to coach my son in playing football (ok, ‘soccer’ if you’re American), I used to tell him to be, “intentional and analytical”. (I think his eyes used to glaze over at that point, since he was only 12 years old!)

But what I meant by that was exactly those four points:

Don’t just kick the ball.

Plan what you’re going to do with it, how you’re going to kick it, and what you want to happen when you kick it.

Then measure whether that’s what actually happened. Did the ball go where you wanted?

Analyse it further – was the speed right, the height, the spin, etc? What might have worked better?

Then you plan to adjust your kick next time to get the effect closer to what you wanted. And then do that!

The performance environment

The performance environment is there because there are other factors around that can affect performance. You could say they’re not directly within your control.

First, there are the risks.

We all live in a world of risk, and businesses operate in a world of risk, where things happen that we cannot control or perfectly predict. Things may look like they’re going well one day, but things may happen that can change that.

Risk management operates on the basis that if we can raise our awareness of risk, even if we can’t precisely calculate it, then we can make informed decisions about how to deal with it – or manage it. It’s all about assessing what might happen that would affect performance.

Internal control is part of the way of dealing with the risks we identify.

Second, there are the stakeholders.

Stakeholders can be anyone that has an interest in the performance of the business, including the owners/shareholders. It’s better to manage their interests intentionally than to leave it to chance.

And one could argue that stakeholder management is just a way of coming up with actions to manage a particular type of risk. Basically, you want stakeholders to work for you, or at least not against you, in the same way as ideally you want risks to work for you (there are upsides to risks as well as downsides) and not against you.

The performance hub

What I call the performance hub is made up of two things that are designed to keep the business going, to keep the engine running, so to speak.

The first of those is resource management.

Clearly, cash is the crucial financial resource. But there’s not much point having cash if you can’t use it to get raw materials, equipment, appropriately skilled people, etc.

So, we need good cash and treasury management. And we need good resource management.

And included within this is resource allocation – deciding how much we can spend on resources in each area of the business.

The other thing is what I’ve labelled transaction management.

This is reflecting on the fact that business performance is, from a financial point of view at least, an aggregation of transactions. And those transactions kick off activities within the business that are managed within processes, and often involve data being transferred between systems and people.

In order to have a smooth running business, we must have transaction processes and data management systems that are geared to facilitating good performance and not just data storage.

Why is business performance management so important for Finance?

So, knowing the things involved in managing business performance is a key part of developing business acumen.

But, for Finance it goes further than that.

It shouldn’t stop at head knowledge and awareness only. It needs to go further, such that we know what we can do to improve business performance management within the businesses we work in.

Finance is in the business to drive performance. And our responsibility for performance management is the way we do that. We help the business to do the right things, and to make the right decisions, to best manage performance. And that leads to better performance.

A few moments thought should at least help you to see that there are some aspects of business performance management where Finance can have an impact by simply improving its own processes. And yet, there are other areas where Finance can work with the business in varying types of collaboration to make improvements.

You can read about a 3-step approach that Finance can use to help the business to manage performance better by downloading my free short guide, How Finance Can Drive Business Performance.

Related Posts

If you want to be a CFO, develop these three skills

Free download available

How Finance Can Drive Business Performance (short guide)

About the author

Andy Burrows has spent more than 25 years working in the Finance function in a variety of businesses. He’s been a Finance Director and a Finance business partner, as well as leading transformation projects.

And now he dedicates his time to helping Finance professionals to level up their impact in the business they work for.

About Supercharged Finance

Andy founded Supercharged Finance in 2016 to provide online resources for Finance professionals wanting to go further and make a bigger impact.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates on new resources to help you make your Finance role add value in the business you work for

[Your information will not be shared with external parties for anything other than the provision of Supercharged Finance products and services.]