Business Acumen for Finance Professionals

By Andy Burrows

What is business acumen?

Business acumen is an extremely important topic for Finance professionals.

Everyone agrees that you need business acumen to be a good CFO. It’s also an essential ingredient for a Finance Business Partner. But, on top of that, we know that Finance as a whole is becoming more business-focused, so business acumen is becoming more fundamental to Finance professional development.

And there are a couple of reasons, at least, for the rising importance of business acumen for Finance professionals.

First, the business landscape is increasingly complex, changing rapidly, and becoming more global, because of the unstoppable drive of new digital and communications technology.

That means that the analytical part of decision-making now needs more than just a commercial CFO. The CFO needs a team they can delegate to, to get involved in helping business decisions.

It has also put non-Finance managers in the business under pressure. They are also being asked to contribute to strategic decisions, and they cry out for help from Finance.

Second, the accounting and reporting processes that were the bread and butter of the Finance function are becoming progressively automated, and therefore less onerous.

The upshot of all this is that the weight of brainpower in Finance is steadily shifting from accounting to business support and decision-making.

In his book, Finance Business Partnering – the search for value, Alan Warner describes business acumen as “understanding what running a successful business is all about, how each function and management team need to make an appropriate contribution to long-term value creation. It is about encouraging fact-based decisions, understanding the importance of strategic advantage and how it can best be applied in different contexts. It is also about understanding the competition and knowing how to beat them, about knowing your customers and how best to meet their needs. And finally, it is about joining in the identification of business opportunities while showing understanding of the pressures and constraints of colleagues.”

Notice the number of times Warner uses the word “understanding”.

Where does this understanding come from? How can we get it? If you’re a young accountant, wanting to progress in your career towards a senior Finance leadership role, or even a CFO role, what can you do to get business acumen?

In many Finance departments, even in those where Finance business partnering is intentionally trained and coached, the business acumen part is seen as something that “comes with experience”. It’s seen as something that grows as you get involved with the business more and more, and you connect the numbers with the activities within the business.

But I’m convinced we can do better than that.

We must be able to break down business acumen into some constituent parts and work out ways to intentionally learn and improve in them. You’ve got to be able to do more than just soak it up subconsciously.

A breakdown of business acumen

Different people seem to have slightly different ways of talking about business acumen. What follows is the way I have decided to talk about it, having done some reading around the topic.

And what I’ll just say up front is that it seems like management thinkers have slightly different ways of outlining business acumen. And it’s one of those situations where we’re actually all saying broadly the same thing, but in a different way.

There are two key things that may look different about my approach if you’ve ever seen any other material on business acumen.

One is that I exclude behavioural skills. That’s because business acumen, for me, sits within a framework of “business-focused Finance skills”. Those are the skills and behaviours that you need to grow and develop in to get you from Accountant to CFO. And I’ve written about this in more detail elsewhere.

The point is that behavioural skills are under a separate category in that framework, because I think it’s more helpful to think of them separately.

The other difference is that, on the other hand, I package quite a few elements into headings below, such as “business performance management”.

Be that as it may, the following are some of the common themes that I see with the “business acumen” category:

- Financial acumen – what a P&L, balance sheet and cashflow statement mean and how they are put together;

- Strategic thinking – how businesses decide how to operate and what activities to prioritise;

- Key aspects of business organisation – common business disciplines (e.g. Marketing, HR, Supply Chain, Operations, IT), their purpose and how they work together;

- Management paradigms – different approaches to managing business, the difference it makes, and how Finance influences (e.g. Beyond Budgeting);

- Business performance management – the elements involved in maximising the performance of the business.

It’s worth recognising that these are all things that business leaders in general need in order to do a good job, whether they’re the CEO, or the Marketing or HR Manager, or the Finance Business Partner.

But there are two other points to make:

Finance has a head start

First, it is apparent that some of the main elements of business acumen are the primary domain of the Finance function.

For instance, “financial acumen” seems to be universally accepted as necessary for business leadership. And this is something that, therefore, business managers come to Finance to help them with and teach them about.

Ever put on a “finance for non-financial managers” course for your non-Finance colleagues? The reason they love it when you do this is because they feel they can’t progress in senior management without having a better understanding of the numbers...

... and that’s something that you take for granted as a trained accountant!

Where does Finance fit?

Second, there are different flavours of business acumen depending on where you sit within the business. So, there’s a Finance slant on business acumen, and an HR spin, and a Marketing flavour, and so on. The thing we have to understand is, seeing the business as a whole, where do we fit in?

Further, as I’ve said many times before, every area of the business generates transactions, and Finance gets to see every transaction. And Finance can’t plan, forecast or report without understanding the transactions and how they’re created. So, Finance has to get involved in every area of the business, and understand how it ticks and how it performs.

Therefore, Finance, led by the CFO, is where colleagues naturally turn for insight into business performance. More than that, investors expect CFOs to make a difference to the performance of the business (i.e. not just understand it and commentate on it).

And that fundamentally comes from understanding business performance management and an ability to use that to improve performance.

Therefore, business performance, business acumen, and being business-focused, are things that are especially relevant to Finance professionals as we develop into business leaders.

Finance drives business performance

And so, the Finance flavour of business acumen is going to be very much focused on business performance management.

And that’s our great, value-adding, contribution to the business – helping everyone involved to manage performance better. Because, as I regularly say, “managing business performance better leads to better business performance... otherwise why bother managing it?”

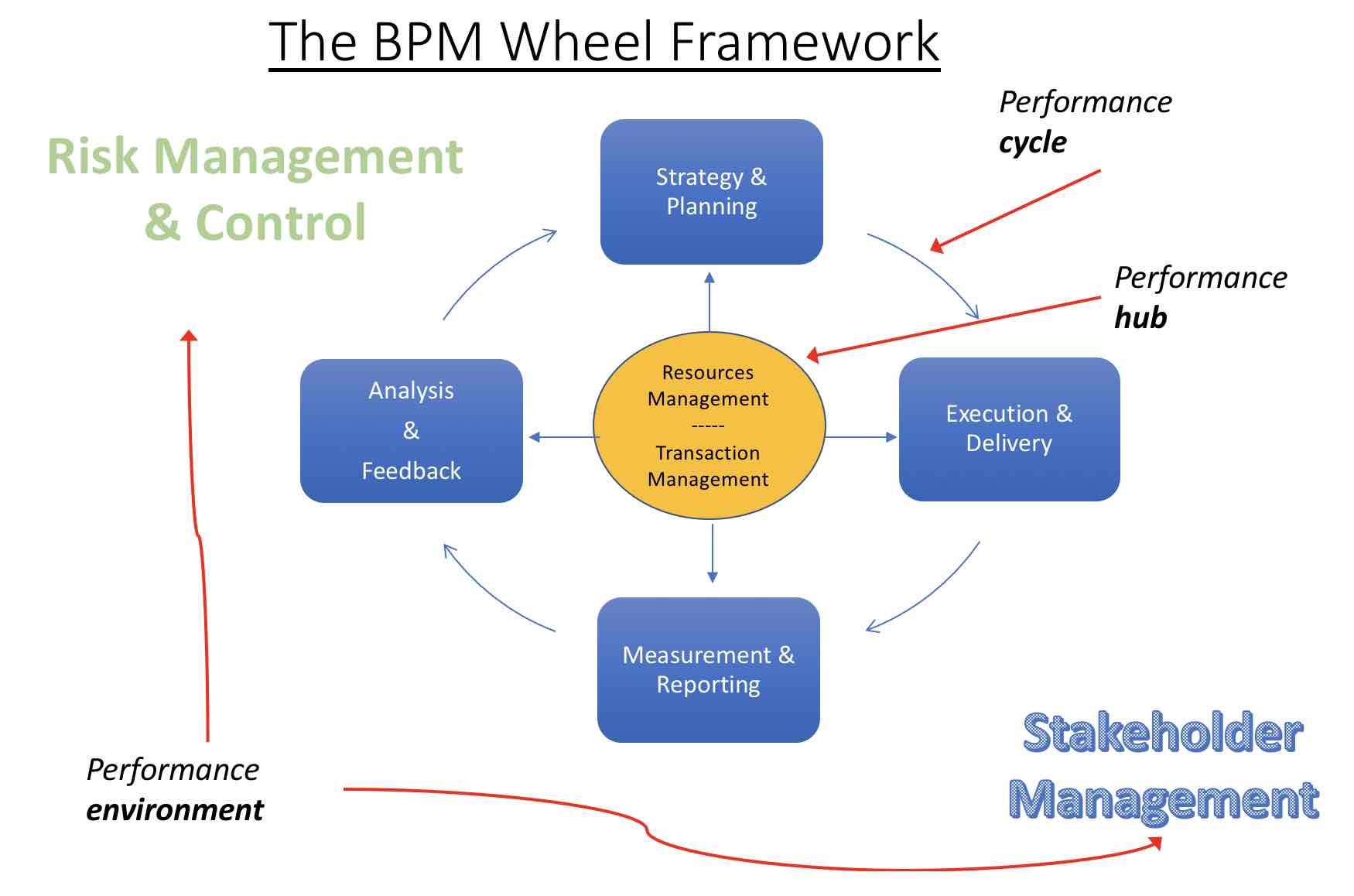

The framework I use for business performance management is what I call the BPM Wheel (see the picture below).

And there’s an approach we can take so that Finance can use this framework to help the business to improve its performance management capabilities.

You can read more about this business performance management framework, and the approach we can take to using it in Finance, by downloading my free short guide, How Finance Can Drive Business Performance.

Related Posts

If you want to be a CFO, develop these three skills

Free downloads available

How Finance Can Drive Business Performance (short guide)

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates on new resources to help you make your Finance role add value in the business you work for

[Your information will not be shared with external parties for anything other than the provision of Supercharged Finance products and services.]